As efforts to move electricity generation to cleaner resources continue, there is no denying the heavy capital investment required — between $3.5 trillion and $4.5 trillion per year globally — to achieve a zero-carbon economy by 2050. This cost is being borne across various industries, public and private funds, and individuals.

High-income countries, including the U.S., will require $1.4 trillion in annual investments economy-wide through 2050.

Where We Are Now

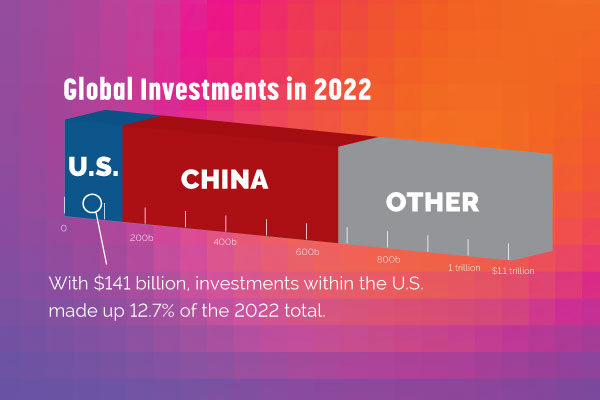

Bloomberg NEF estimated investments in the global transition topped $1.1 trillion in 2022. This investment is up $261 billion from 2021 and more than double the 2019 total.

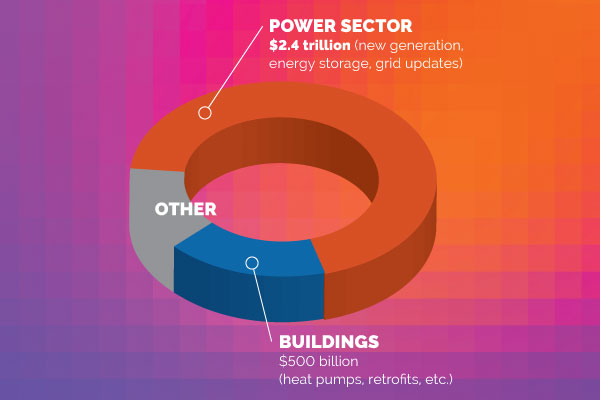

- $550 billion supported investments in energy supply, including renewables, nuclear, energy storage, hydrogen, and CCS. Plus, an additional $274 billion into power grids.

- Investment in “demand-side” aspects (transportation, home heating) outpaced supply investments. These include personal investments in electrification from individuals.

There was also $119 billion in climate-tech corporate finance, via venture capital, private equity, and public equity markets in 2022.

What’s Needed

To reach 2050 net zero goals, BNEF forecasts that total annual global investments need to more than triple through 2030, at $4.5 trillion, and peak in the 2040s with $7.87 trillion per year.

- The majority of the added investments need to occur in electrified transport

- Renewable energy and electric grid investments surpass $2 trillion annually through 2050

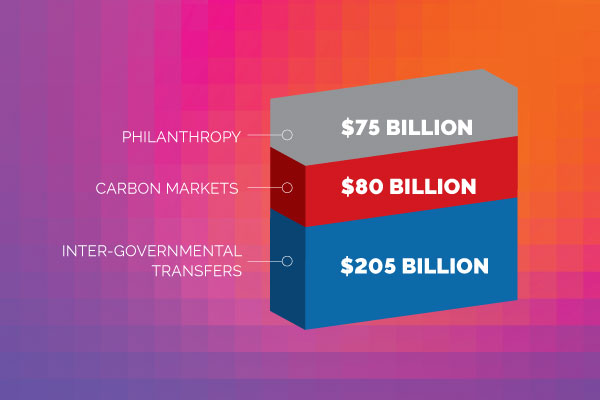

The Energy Transitions Commission suggested that $300 billion per year through 2050 could be raised to support the transition through:

- Intergovernmental transfers ($205 billion)

- Carbon markets ($80 billion)

- Philanthropy ($75 billion)

Sources:

Financing the Transition: How to Make the Money Flow for a Net-Zero Economy. Energy Transitions Commission. March 2023.

Energy Transition Investment Trends 2023. BloombergNEF. January 2023.